How can Artificial Intelligence Help Traders Succeed?

The Classic Approach to System Design

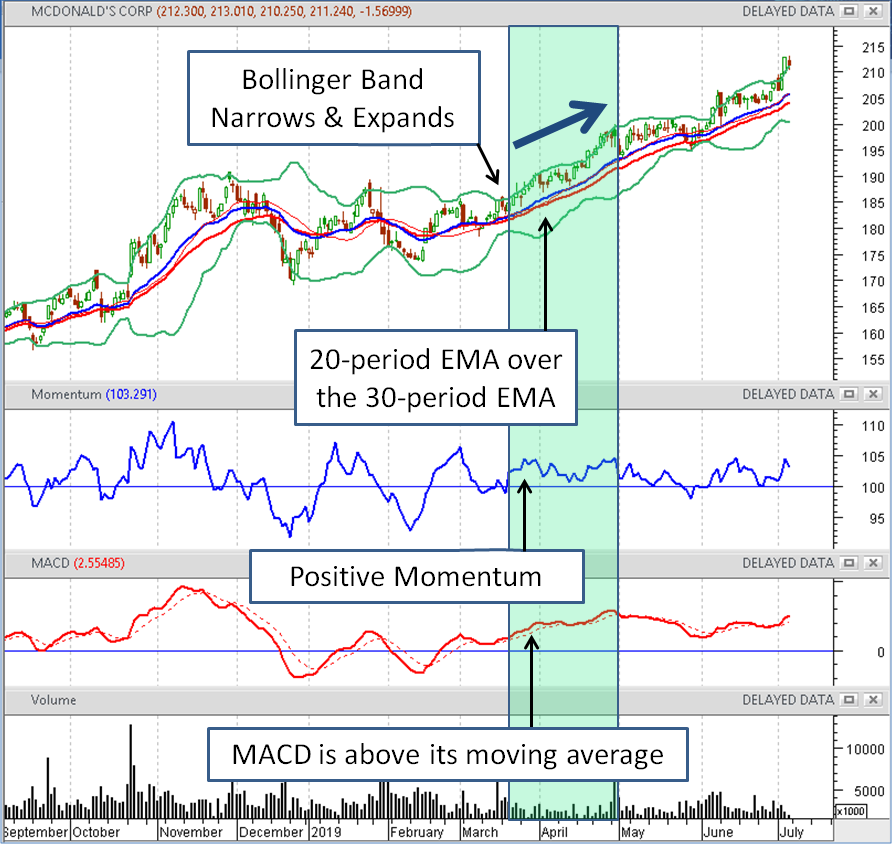

As System Developers, we look for relationships between Indicators to determine which conditions lead to a high-probability trade. For example ...

Buy When:

- The Bollinger Band Channel narrows and then expands,

- The 20-period EMA is over the 30-period...

- Momentum is positive...

- MACD is above its moving average...

This is how Technical Analysts have built Trading Systems for the past 50 years.

An Infinite Number of Possibile Trading Rules

Indicator Definitions

A very large number of indicators are available for Traders to use. To the right is a partial list of MetaStock indicators. Each one can have an infinite number of variations, such as RSI(7), RSI(14), RSI(21) and so on.

Let’s talk about just one variation – the RSI(14) indicator.

Possible Interpretations

Above/Below Moving Average

RSI(14) > MOV(RSI(14),S,20)

Bar to Bar Comparisons

RSI(14) > Ref(RSI(14),-1)

Divergence with Price

Slope (RSI(14),20) > Slope(C,20)

Above/Below an important Level

RSI(14) < 30

Applying Another Indicator

Mom (RSI(14), 7) > 0

Complex Relationships

RSI(14) * (O-C)/C

Change Over N Bars

RSI(14) – Ref(RSI(14),-N)

AND MANY MORE...

An INFINITE Number of inter-market relationships.

We also have an infinite number of inter-market relationships, like...

Momentum on any index or group: Positive on the S&P 500 Index.

Key Levels on any index or group: $VIX Above 20.

Technical Indicators on indexes or groups: The Dow 30 breaks its 55-period Simple Moving Average

AND MANY MORE...

Partial List of the Indicators in MetaStock

Using Artificial Intelligence to Find Profitable Trading Rules

Artificial Intelligence has many definitions, but perhaps the most inclusive is “Algorithms that search for complex patterns in very large amounts of data, in a way that would be impossible for any human to accomplish.”

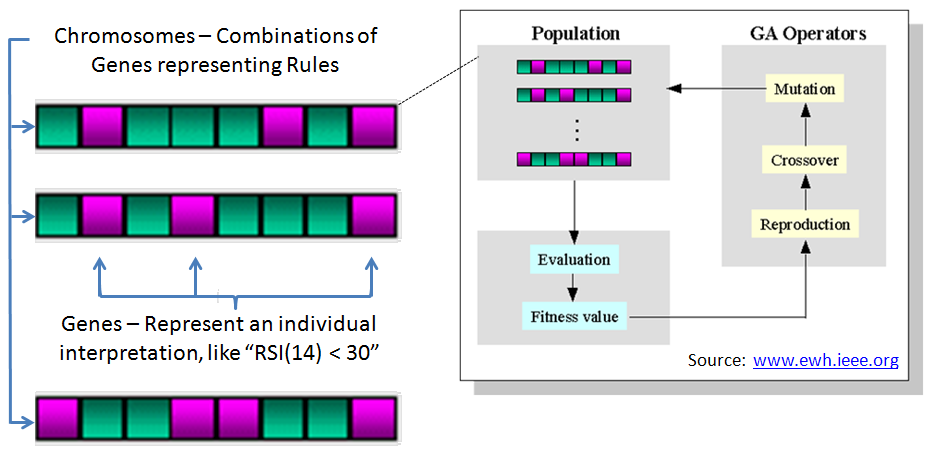

At Fulgent Technologies, we use many techniques to search among the trillions of possible combinations of indicators and relationships. Among them is an evolutional search method called a Genetic Algorithm.

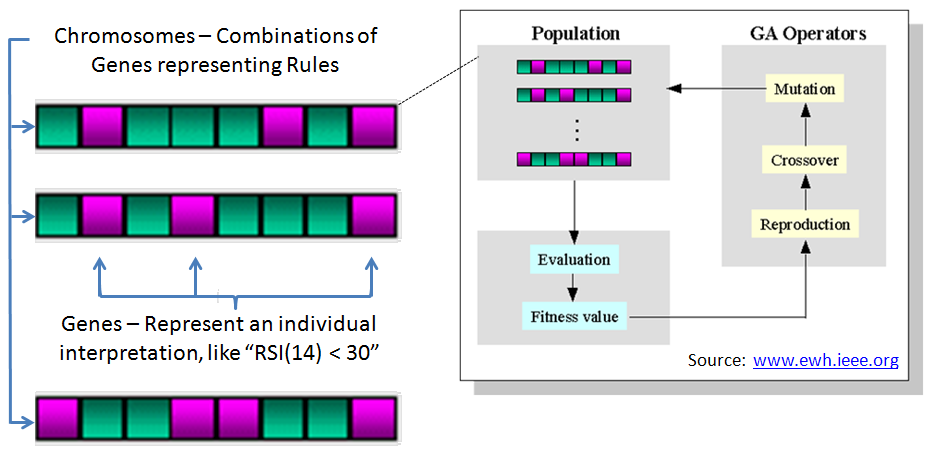

Genetic Algorithm

- The algorithm builds a list of “Chromosomes” composed of “Genes”. The Genes are individual indicator interpretations that could be combined to produce a profitable Rule.

- This illustration shows 3 Chromosomes and 8 Genes, but in the actual Algorithm there are HUNDREDS of Genes and THOUSANDS of Chromosomes generated in each “iteration”.

- The algorithm tests the profitability of each Chromosome (a potential Rule) and saves it to the Knowledge Base if it shows enough profitability.

THEN, the algorithm uses Crossover and Mutation to combine good Rules with other possible Rules. As a Result, the Rules found get more and more profitable.

The A.I. continues in this process, running thousands of iterations on over 100,000 bars of historical price data, each of which adds a few new “Rules”. The resulting Knowledge Base can contain thousands of Rules – all of which have been internally validated to have a high probability of success.

How can Artificial Intelligence Help Traders Succeed?

How can Artificial Intelligence Help Traders Succeed?

The Classic Approach to System Design

The Classic Approach

to System Design

As System Developers, we look for relationships between Indicators to determine which conditions lead to a high-probability trade. For example ...

Buy When:

- The Bollinger Band Channel narrows and then expands,

- AND the 20-period EMA is over the 30-period...

- AND Momentum is positive...

- AND MACD is above its moving average...

This is how Technical Analysts have built Trading Systems for the past 50 years.

AN INFINITE NUMBER OF POSSIBILE TRADING RULES

Indicator Definitions

A very large number of indicators are available for Traders to use. To the right is a partial list of MetaStock indicators. Each one can have an infinite number of variations, such as RSI(7), RSI(14), RSI(21) and so on.

Let’s talk about just one – the RSI(14) indicator.

Possible Interpretations

Above/Below Moving Average

RSI(14) > MOV(RSI(14),S,20)

Bar to Bar Comparisons

RSI(14) > Ref(RSI(14),-1)

Divergence with Price

Slope (RSI(14),20) > Slope(C,20)

Above/Below an important Level

RSI(14) < 30

Applying Another Indicator

Mom (RSI(14), 7) > 0

Complex Relationships

RSI(14) * (O-C)/C

Change Over N Bars

RSI(14) – Ref(RSI(14),-N)

AND MANY MORE...

An INFINITE Number of inter-market relationships.

We also have an infinite number of inter-market relationships, like...

Momentum on any index or group: Positive on the S&P 500 Index.

Key Levels on any index or group: $VIX Above 20.

Technical Indicators on indexes or groups: The Dow 30 breaks its 55-period Simple Moving Average

AND MANY MORE...

Partial List of the Indicators in MetaStock

USING ARTIFICIAL INTELLIGENCE TO FIND PROFITABLE TRADING RULES

Artificial Intelligence has many definitions, but perhaps the most inclusive is “Algorithms that search for complex patterns in very large amounts of data, in a way that would be impossible for any human to accomplish.”

At Fulgent Technologies, we use many techniques to search among the trillions of possible combinations of indicators and relationships. Among them is an evolutional search method called a Genetic Algorithm.

Genetic Algorithm

- The algorithm builds a list of “Chromosomes” composed of “Genes”. The Genes are individual indicators that could be combined to produce a profitable Rule.

- This illustration shows 3 Chromosomes and 8 Genes, but in the Algorithm there are HUNDREDS of Genes and THOUSANDS of Chromosomes in each “iteration”.

- The algorithm tests the profitability of each Chromosome (a potential Rule) and saves it to the Knowledge Base if it shows enough profitability.

THEN, the algorithm uses Crossover and Mutation to combine good Rules with other possible Rules. As a Result, the Rules found get more and more profitable.

The A.I. continues in this process with new Genes and runs thousands of iterations on over 100,000 bars of historical price data, each of which adds a few “Rules”. The resulting Knowledge Base can contain thousands of Rules – all of which have been internally validated to have a high probability of success.

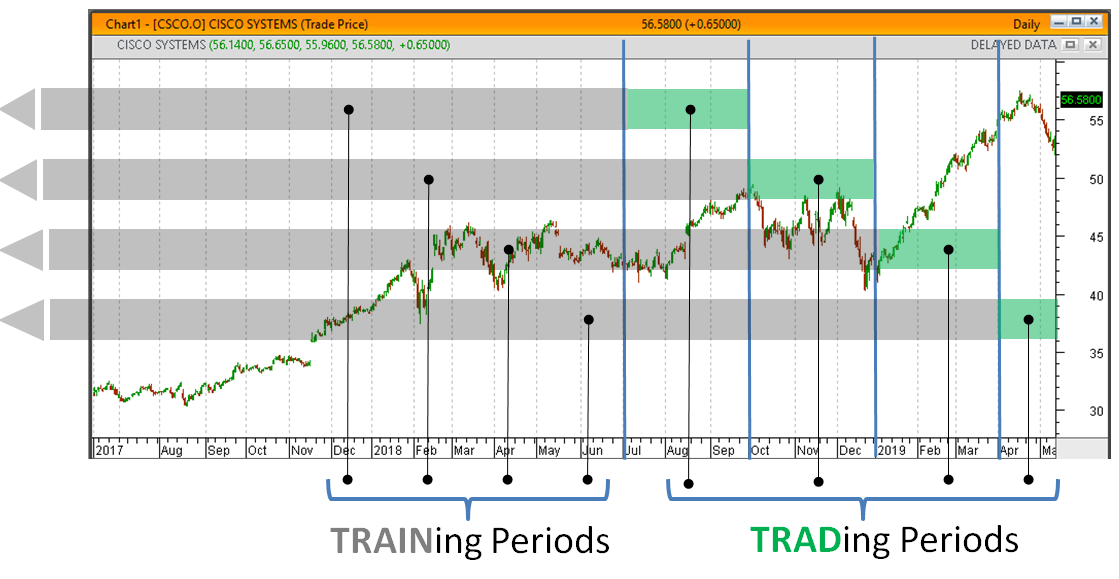

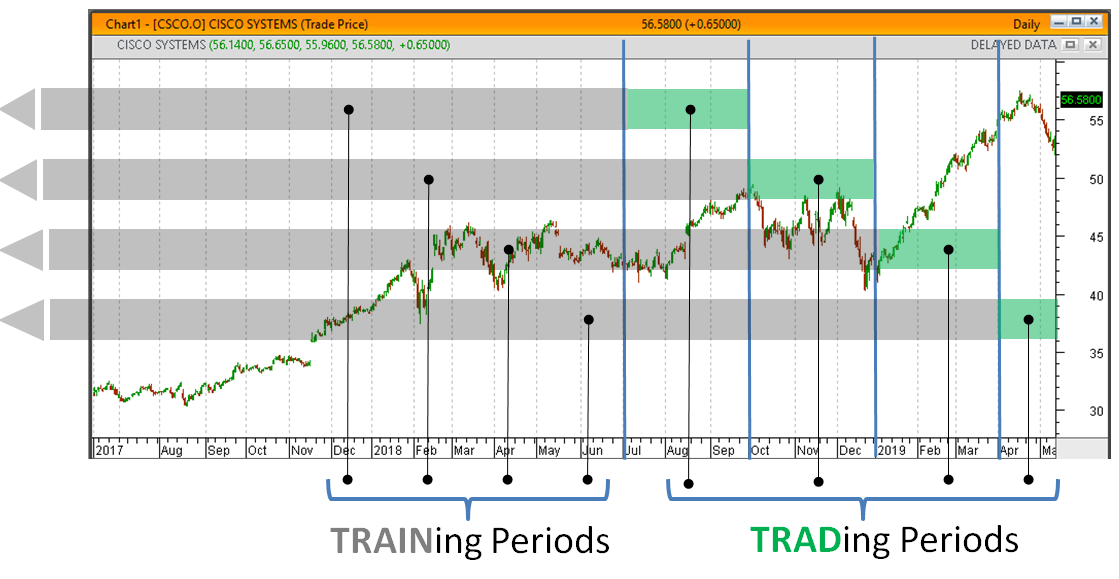

THE TRAINING PROCESS

The Training Process

When the AI is trained on historical data, great care is taken to ensure that “Out of Sample” periods are reserved to avoid “curve fits” to the data.

We update the Knowledge Base periodically (typically quarterly) so the TRADing periods (marked in green) are actual “Out of Sample” periods that the AI has not “seen” or trained to. As a user, you are always seeing Signals that are in these rolling, “Out of Sample” periods.

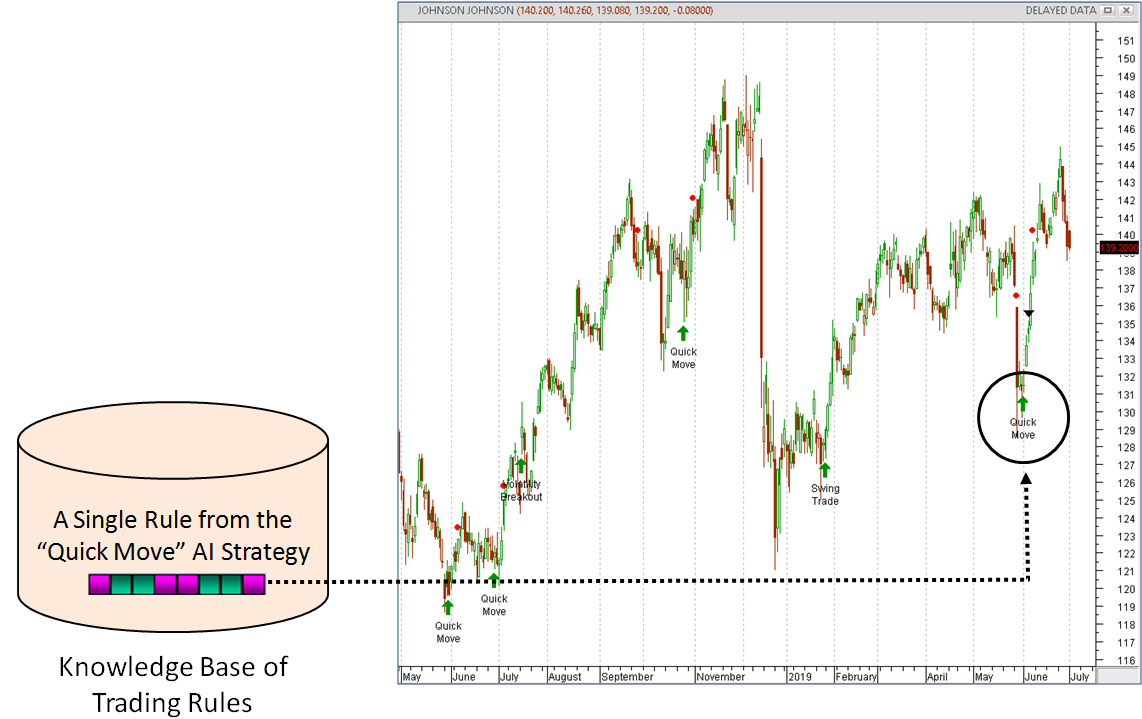

Result: The Best Possible Trading Opportunities

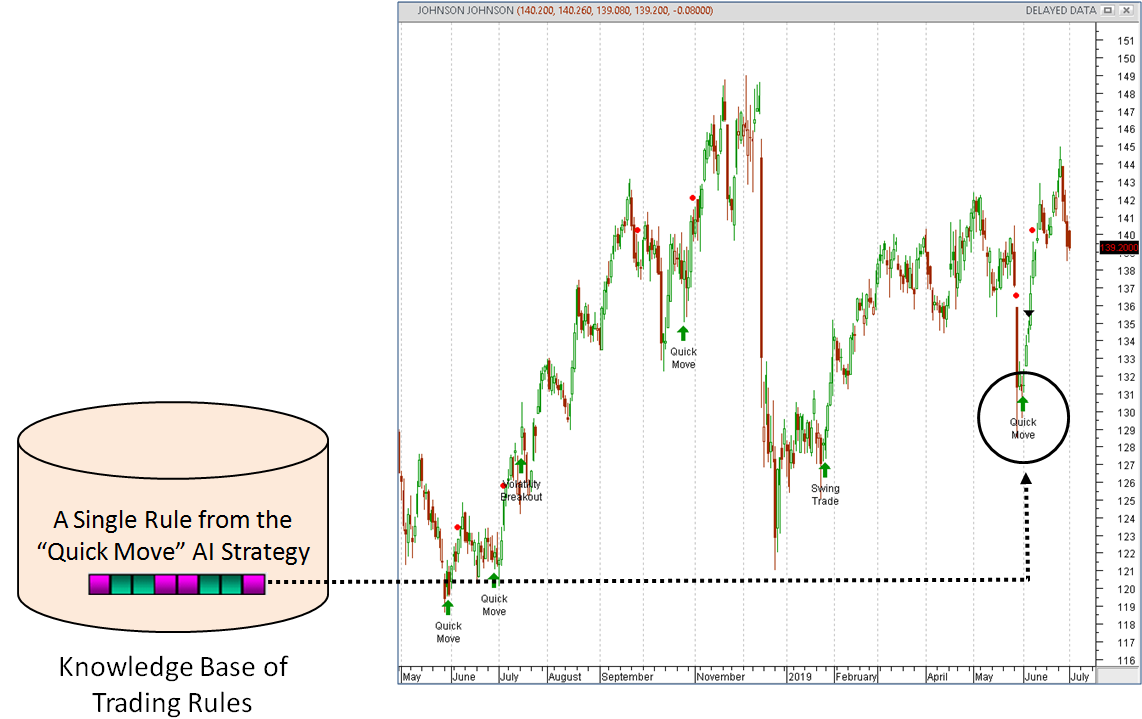

This chart from MetaStock shows some of the Signals generated by the AI Engine. Statistics on each Rule are also provided so the Trader can see which Rules have the highest probability for success.

Some traders may want to “confirm” the AI Signals with other methods. But after using Fulgent AI for a while, we believe they will find this less and less necessary. While no Trading System can guarantee profitability, we have found the opportunities generated by Fulgent AI to be superior to those generated by any other approach we have seen.

When the AI is trained on historical data, great care is taken to ensure that “Out of Sample” periods are reserved to avoid “curve fits” to the data.

We update the Knowledge Base periodically (typically quarterly) so the TRADing periods (marked in green) are actual “Out of Sample” periods that the AI has not “seen” or trained to. As a user, you are always seeing Signals that are in these rolling, “Out of Sample” periods.

Result: The Best Possible Trading Opportunities

A Knowledge Base of Rules is generated that identifies High Probability Trading Opportunities.

This chart from MetaStock shows some of the Signals generated by the AI Engine. Statistics on each Rule are also provided so the Trader can see which Rules have the highest probability for success.

Some traders may want to “confirm” the AI Signals with other methods, which is reasonable. But after using Fulgent AI for a while, we believe they will find this less and less necessary. While no Trading System can guarantee profitability, we have found the opportunities generated by Fulgent AI to be superior to those generated by any other approach we have seen.

Call Us: 800-880-0338

Email Us: sales@fulgent.ai

Fax Us: 512-345-4225

Following over 20 years of experience with A.I. the staff at Fulgent is now focused on ADAPTIVE Machine Learning, where computers learn to trade the markets in the same way human traders do.

Call Us: 800-880-0338 Email Us: sales@fulgent.ai Fax Us: 512-345-4225

Following over 20 years of experience with A.I. the staff at Fulgent is now focused on ADAPTIVE Machine Learning, where computers learn to trade the markets in the same way human traders do.

Enter your text here...