Fulgent AI for MetaStock is a robust Artificial Intelligence Engine for the MetaStock platform.

While some companies claim to use Artificial Intelligence to find Trade Ideas, the Fulgent AI Engine is based on true Artificial Intelligence techniques using Neural Networks and Genetic Algorithms developed over 20+ years.

Fulgent measures hundreds of indicators and cross-market measurements over long term historical stock market data to produce accurate trading opportunities. See the Process page to learn more about how Fulgent AI finds great Trade Ideas.

”Fulgent AI for MetaStock”

A 12-Minute Video by Ed Downs

Fulgent AI for MetaStock is a robust Artificial Intelligence Engine for the MetaStock platform.

While some companies claim to use Artificial Intelligence to find Trade Ideas, the Fulgent AI Engine is based on true Artificial Intelligence techniques using Neural Networks and Genetic Algorithms developed over 20+ years.

Fulgent measures hundreds of indicators and cross-market measurements over long term historical stock market data to produce accurate trading opportunities. See the Process page to learn more about how Fulgent AI finds great Trade Ideas.

Included Strategies

Included Strategies

The Fulgent AI – Stocks strategy suite is included with Fulgent AI for MetaStock.

Four AI Strategies are included:

● Major Market Reversals

● Classic Swing Trades

● Quick (3-Day) Moves

● Volatility Breakouts

The Fulgent AI – Stocks strategy suite is included with Fulgent AI for MetaStock.

Four AI Strategies are included:

● Major Market Reversals

● Classic Swing Trades

● Quick (3-Day) Moves

● Volatility Breakouts

Major Market Reversals – This A.I. Strategy was trained to identify those unique times when a stock is oversold and other forces, including cross-market indicators provide evidence of a strong move. Wide, intelligent stops are used to capture as much profit as possible.

Classic Swing Trades – This AI Strategy looks for classic “Reversion” Swing Trades. The intelligent Exits establish Stops below the lows of a move and look to take profits on the upper boundary of a Swing.

Quick (3-Day) Moves – This AI Strategy was trained to maximize profits 3 bars after the Entry. This makes a great Strategy for active traders looking to trade the very quick explosive moves that often happen when volatility increases.

Volatility Breakouts – This AI Strategy was trained to find “Volatility Breakouts” - potential moves indicated by unusually high volatility in the direction of the breakout. These kinds of trades typically run for several bars before hitting resistance. The Strategy employs a moderate Trailing Profit Exit to encourage trades to reach their “apex” before signaling an Exit.

Simple by Design

Simple by Design

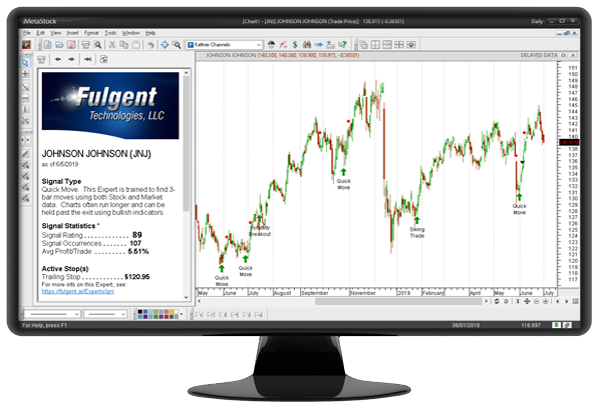

The Expert Advisors explain each Signal and show where the Stops from the Strategy are placed on each bar. Because four different AI Strategies are provided, traders have a target-rich environment to trade.

Fulgent AI provides clear, actionable Signals without the need for interpretation using additional indicators. MetaStock users can leverage their success with other Add-Ons by confirming Signals from Fulgent with techniques they are familiar with.

SEE IT FOR YOURSELF!

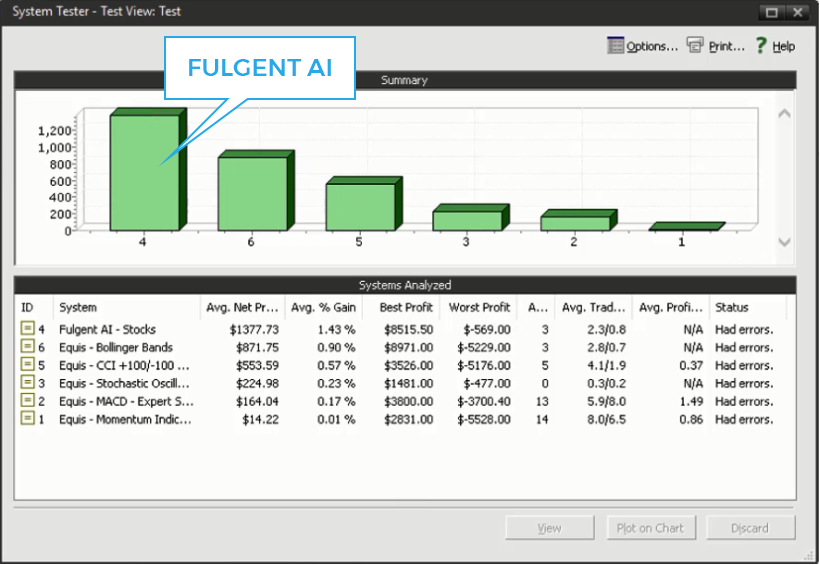

To the right is a System Test of Fulgent AI versus five Systems in MetaStock. Fulgent AI was by far the best performer. We have yet to find a System that performs better than Fulgent AI.

If you are looking for actionable Trade Ideas, look no further than Fulgent AI.

Call Us: 800-880-0338 Email Us: sales@nirvsys.com Fax Us: 512-345-4225

Following over 20 years of experience with A.I. the staff at Fulgent is now focused on ADAPTIVE Machine Learning, where computers learn to trade the markets in the same way human traders do.

Call Us: 800-880-0338

Email Us: sales@nirvsys.com

Fax Us: 512-345-4225

Following over 20 years of experience with A.I. the staff at Fulgent is now focused on ADAPTIVE Machine Learning, where computers learn to trade the markets in the same way human traders do.